A Guide to Accounts Payable Automation

by

Kirti Darani - August 28, 2024

by

Kirti Darani - August 28, 2024

Challenges With Paper and Systems

What Is AP Automation?

How Does Accounts Payable Automation Work?

| Aspect | Manual Accounts Payable | Automated Accounts Payable |

|---|---|---|

| Data Entry | Manual entry of invoices, purchase orders, and receipts | Automated data capture from invoices using OCR or e-invoicing |

| Approval Process | Physical routing of documents for approval | Digital workflow automation for approvals |

| Invoice Matching | Manual matching of invoices, POs, and receipts | Automatic 3-way matching of invoices with POs and receipts |

| Error Handling | Higher risk of human errors in data entry | Reduced errors due to automated checks and balances |

| Processing Time | Time-consuming with manual handling and routing | Faster processing due to automation and streamlined workflows |

| Audit Trail | Paper-based or limited electronic records | Comprehensive digital audit trails for tracking |

| Duplicate Payments | Risk of duplicate payments due to manual oversight | Automated systems flag and prevent duplicate payments |

| Vendor Communication | Manual communication via phone or email | Automated notifications and updates to vendors |

| Cost | Higher operational costs due to labor-intensive processes | Lower costs due to reduced manual labor and paper usage |

| Scalability | Limited scalability, difficult to manage increased volume | Easily scalable to handle large volumes without additional resources |

| Payment Processing | Manual check writing or manual entry of electronic payments | Automated payment processing and scheduling |

| Compliance and Reporting | Manual tracking and reporting, prone to delays | Real-time compliance and reporting with accurate data |

| Storage and Retrieval | Physical storage of documents, difficult retrieval | Digital storage with easy and fast retrieval |

Why Automate Accounts Payable? Top Benefits of Accounts Payable Automation

-

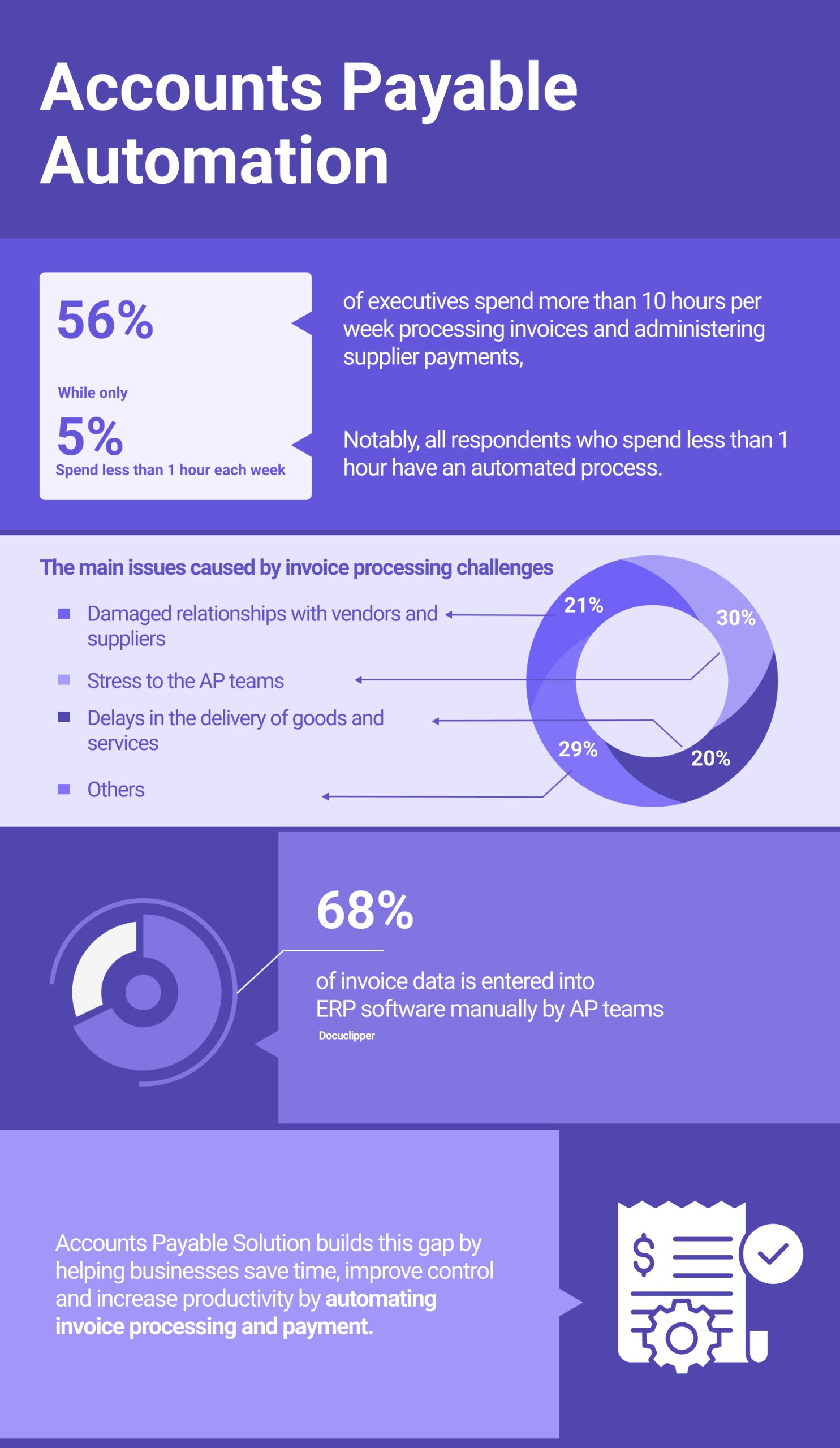

Efficiency and Productivity: Manual AP processes are slow and labor-intensive. Automation speeds up invoice processing, reduces delays, and frees up employees to focus on more strategic tasks. Let’s understand it more with a real life example:

A manufacturing company’s Accounts Payable team faced a bottleneck with manual invoice processing. This time-consuming task consumed 75% of their day, hindering efficiency and accuracy.

OpenBots automated solution transformed their operations. By automating invoice location and upload, the AP team gained the capacity to focus on value-added activities like payment follow-ups and vendor support. This transformation improved efficiency, accuracy, and overall performance. Read full story here.

- Enhanced Accuracy: Human error is a common issue in manual data entry. AP Automation minimizes errors by using OCR and other technologies to capture and validate data accurately.

- Cost Savings: AP Automation can significantly reduce operational costs. The systems are designed to help avoiding late payment penalties and taking advantage of early payment discounts.

- Better Compliance and Security: Automated workflows ensure that invoices are processed according to company policies and regulatory requirements, reducing the risk of non-compliance.

- Visibility and Scalability: Real-time access to financial data through automated reporting tools allows for better decision-making and handle complexities as business scales.

Best Practices for Implementing AP Automation

- Involve Stakeholders Early:

- Engage key stakeholders, including finance, IT, and procurement, in the planning and implementation process to ensure alignment and buy-in.

- Set Clear Objectives:

- Define clear objectives for what you want to achieve with AP Automation, such as reducing processing time, improving accuracy, or increasing visibility.

- Start with a Pilot:

- Begin with a pilot program to test the AP Automation software in a controlled environment before rolling it out across the organization.

- Ensure Data Accuracy:

- Clean and standardize your data before implementing AP Automation to avoid issues with data extraction and validation.

- Monitor and Measure Success:

- Establish key performance indicators (KPIs) to measure the success of your AP Automation implementation and identify areas for improvement.

How to Select an Accounts Payable Automation Software?

1. Integration Capabilities:

2. User Experience:

3. Scalability:

4. Vendor Support:

5. Cost:

6. Security and Compliance:

Conclusion

FAQs

About Kirti Darani

Meet Kirti, a senior copywriter with a Master's degree in marketing and a passion for technology. As a skilled wordsmith, she specializes in helping tech leaders articulate their vision and translate complex concepts into engaging content that resonates with their audience. Outside of work, Kirti enjoys expressing her artistic side through nail art and photography.Recent Posts

Related Blog Posts

7 High-Impact Use Cases of RCM Automation

The current financial pressures on healthcare providers are increasing: declining margins, staffing difficulties, increasing administrative workloads, regulatory complexity, and patient […]

Agentic AI’s Untapped Power in Streamlining Prior Authorizations

The original goal of prior authorization was to help keep healthcare costs down, not to get in the way of […]

OpenBots Launches Suite of AI Agents for Autonomous Revenue Cycle Management

OpenBots Inc. is transforming healthcare financial operations with the launch of its AI-powered suite of eight Autonomous Revenue Cycle Management (RCM) Agents…