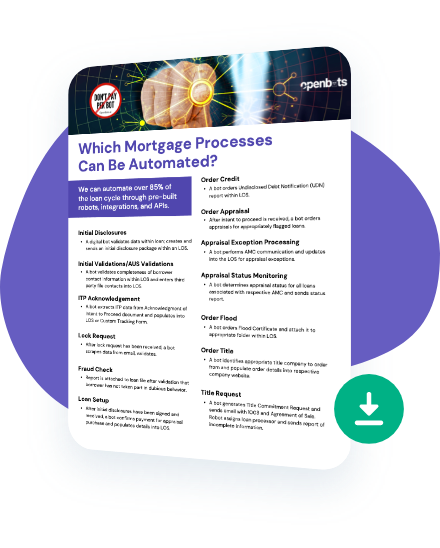

Mortgage Automation Solutions

for 90% of your Current Operational Processes

Did you know that over 90% of the process of ordering services (e.g. ordering appraisals, credit, flood, fraud reports, etc.) within a Loan Origination System can be automated?

Did you also know these automations can be built at no licensing costs per bot?